Let’s Expatiate A Bit on What SAFEs Are

SAFEs are almost certainly the most common investment notes in the venture capital space today. For proper context, they were created in 2013 by YCombinator, a Silicon Valley business accelerator as an easy and standardized way out for startups to raise bridge funding before going on to ultimately raise funding via a major priced equity round.

A SAFE is a Simple Agreement for Future Equity. Simply put, it is an instrument where the investor gives money to a startup in exchange for a promise from the startup to give shares to the investor at a future date when the startup raises money on a priced equity round.

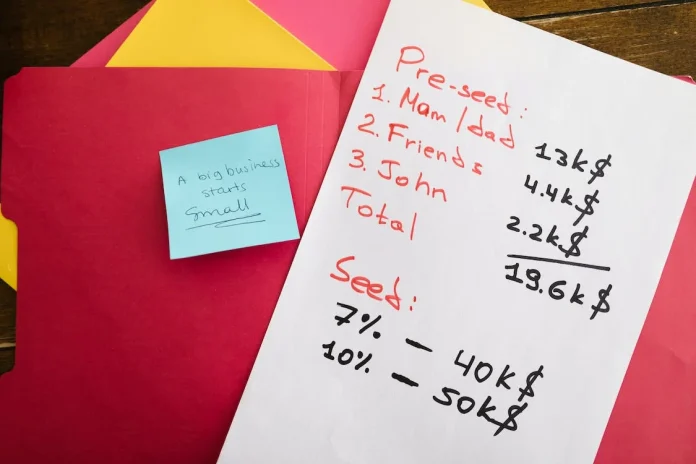

When initially introduced by YCombinator, the objective of the SAFE was to ease out the process of investing in an early-stage startup through seed financing, prior to the company proceeding with a Series A venture financing round. The seed round typically served as a bridge to future financing and the SAFE was regarded as a standardized contractual mechanism for issuing shares in that subsequent financing, thereby offering potential advantages to investors who participated early.

At the time of the subsequent financing, the initial SAFE investment converts into shares, offering the investor either a discounted purchase price or a conversion hinged on a capped valuation of the startup.

Save for about two clauses, SAFEs are typically a short and non-negotiable five-pager with the valuation caps and investment amount being the only negotiable clauses. Please take note that this is on a general note, because although a SAFE Note may not be negotiable, investors and startups may desire to negotiate the terms of a SAFE by issuing attendant Side letters which is to be read alongside an issued SAFE.

In contrast to conventional equity (share purchase/subscription) or debt (loan) instruments, a SAFE does not entail an immediate valuation of the startup or establish a maturity date. Rather, it postpones the assessment of the startup’s valuation and conversion into equity until a subsequent financing round or until when a specified triggering event occurs. Following a triggering event, such as a subsequent equity financing round, acquisition, or initial public offering (IPO), the SAFE then transitions into equity in the startup based on prearranged terms.

What Should Smart Entrepreneurs Take Note Of?

- Triggering Events for the Conversion of a SAFE Note

Please take note that the conversion of a SAFE note into outright shares owned by a SAFE Note holder is not immediate but upon the occurrence of a later “triggering” event. Examples of triggering events include: the next financing round where the startup sells equity (a priced round) to new investors; an IPO or an acquisition of the company.

- How SAFEs Convert into Shares

Upon the occurrence of a triggering event, the SAFE note undergoes conversion into shares. The quantity of shares allocated to the investor is dictated by the provisions outlined in the SAFE note. Often, the inclusion of a valuation cap and/or discount rate results in the SAFE investor obtaining shares at a lower price per share compared to other participants in the ongoing round of financing. Kindly take note that following the conversion, a SAFE note ceases to exist, and the investor assumes the role of a standard equity holder, typically holding preferred stock, also known as preference shares.

- Valuation Cap

This is a predetermined fair limit that a company’s valuation is pegged at. It sets the maximum price of shares at which a SAFE can convert into equity. This pre-negotiated sum “caps” the conversion price when shares are issued at a priced equity round.

- Discount Rate

This term gives a deal where the price for each share upon a conversion event is cheaper than what future investors will pay. It’s a reward for early SAFE investors, giving them more company ownership for the monies they invested when the company gets valued in the future.

- Pro Rata Rights

This is a clause that enables a SAFE note holder to keep his percentage of shares in a company’s share capital when the company eventually raises financing via a priced round. The SAFE Note holder has the option to buy more shares if they want to, but they do not have to.

- Conversion Events

A conversion event encompasses three primary scenarios in which investors (a SAFE Note Holder) may realize returns: the insolvency event, the liquidity event, and the dissolution event.

- Insolvency Event

This event typically denotes a circumstance wherein a company is incapable of fulfilling its financial obligations, resulting in an inability to settle its outstanding debts. Insolvency may prompt legal proceedings such as administration, liquidation, receivership, or bankruptcy.

2. Liquidity Event

A liquidity event signifies a situation or occurrence enabling investors to liquidate or divest their ownership stakes in a company. This may involve the sale of the company through acquisition by another entity, an initial public offering (IPO), a merger, or any other event facilitating the conversion of investment into cash.

3. Dissolution Event

This event pertains to the formal cessation or winding down of a company’s operations. Dissolution may be voluntary, wherein the company’s proprietors elect to terminate operations, or involuntary, whereby external entities such as creditors or regulatory bodies compel closure. Following dissolution, the company ceases to exist, and its assets are liquidated to settle outstanding liabilities. Any residual assets are subsequently apportioned among the shareholders.

- Equity Type

SAFE note holders are typically issued preference shares in a Company’s share capital. Preference shares often carries additional rights and protections when compared to ordinary/ common shares.

Are SAFEs Risky?

The simplicity of a SAFE Instrument coupled with its flexibility in fundraising without immediate valuation and equity allocation makes it an attractive investment structure instrument for startups. For investors, a properly negotiated SAFE poses a potential for high returns on investment. Devices such as valuation caps and discount rates also place SAFE Note holders in an advantageous position particularly in future priced rounds. However, it is important for investors to realize that a conversion event may never be triggered! This means that it is possible for an investor to receive nothing in return for investments stashed in a company. In the event that the company in which you have invested in generates adequate revenue and cash flow to obviate the necessity for future fundraising, and this raise serves as your trigger for a conversion of the SAFE Note into actual equity in the Company, you are at a disadvantage. Also, in the event that the company remains un-acquired by another entity, you will not recoup your investment as you hold no direct ownership stake in the company. These investments carry significant risk, and there exists a remote possibility of experiencing a complete loss of the invested capital. You also have to understand that with a SAFE, as an investor, you have no direct governance control or right of observation over the company you have invested in. You also have no right to receive or audit the financial statements of the company so as to be able to evaluate the health of the company you have invested your money into. A SAFE offers no water tight protection to an investor although it is a note that is fair enough and advantageous to a startup. However, none of this is to dissuade serious minded investors from employing a SAFE to structure their investment in a Company. There is a way an investor set on structuring investments via a SAFE Note can employ certain protective devices which often becomes operational upon the conversion of the SAFE. This device is in form of a ROBUST SIDELETTER.

Using a Side letter as a Protective Device

It is the smart investor that issues a sideletter alongside a SAFE. Although most of these rights, unless intentionally customized by your attorney, generally arise upon the conversion of a SAFE, a side letter ensures that the investor enjoys specific privileges and protections through securing additional rights plus the rights made available in a SAFE. The following are examples of the protective devices that may be employed in a Sideletter: right of first offer, right of first refusal, pro rata rights, info rights, board observer rights, and most-favored nation provisions etc.

Tracking How Much Ownership an Entrepreneur Has Sold to Investors

When a company raises funds through SAFE notes, founders may overlook monitoring the portion of their company sold because SAFE notes don’t immediately convert into shares. However, the fact that the dilution of the company’s ownership to investors is not immediately apparent does not negate the impact when a SAFE Note converts. It is wise for founders to consistently track and manage their cap table. The following are useful tools that can help you manage your cap table: Carta and captable.io.

The Legal Implications

While SAFE notes offer simplicity, it is essential for startups and investors alike to grasp their legal implications fully. Clear comprehension of terms like conversion triggers and post-money valuation caps can prevent future disputes. Seeking advice from a seasoned legal advisor is highly recommended to tailor the agreement to meet the parties’ unique needs. An experienced professional can assist in negotiations, ensuring fairness and safeguarding interests.

Looking for personalized guidance for your next investment round? Kindly reach out to us via: hello@unicornvalleylaw.com

About the Author

Taiwo Lawal Esq. is a corporate and transactional lawyer. With about half a decade’s experience servicing startups (including on transactions regarding intellectual property rights), she is the founder of Unicorn Valley Law, doing what she loves the most- providing bespoke advisory from the “well of water” within her.

Taiwo is happy to read from you and provide bespoke solutions to your startup’s legal and commercial needs. Kindly write her via taiwo@unicornvalleylaw.com or schedule a call via calendly here: (get in touch).